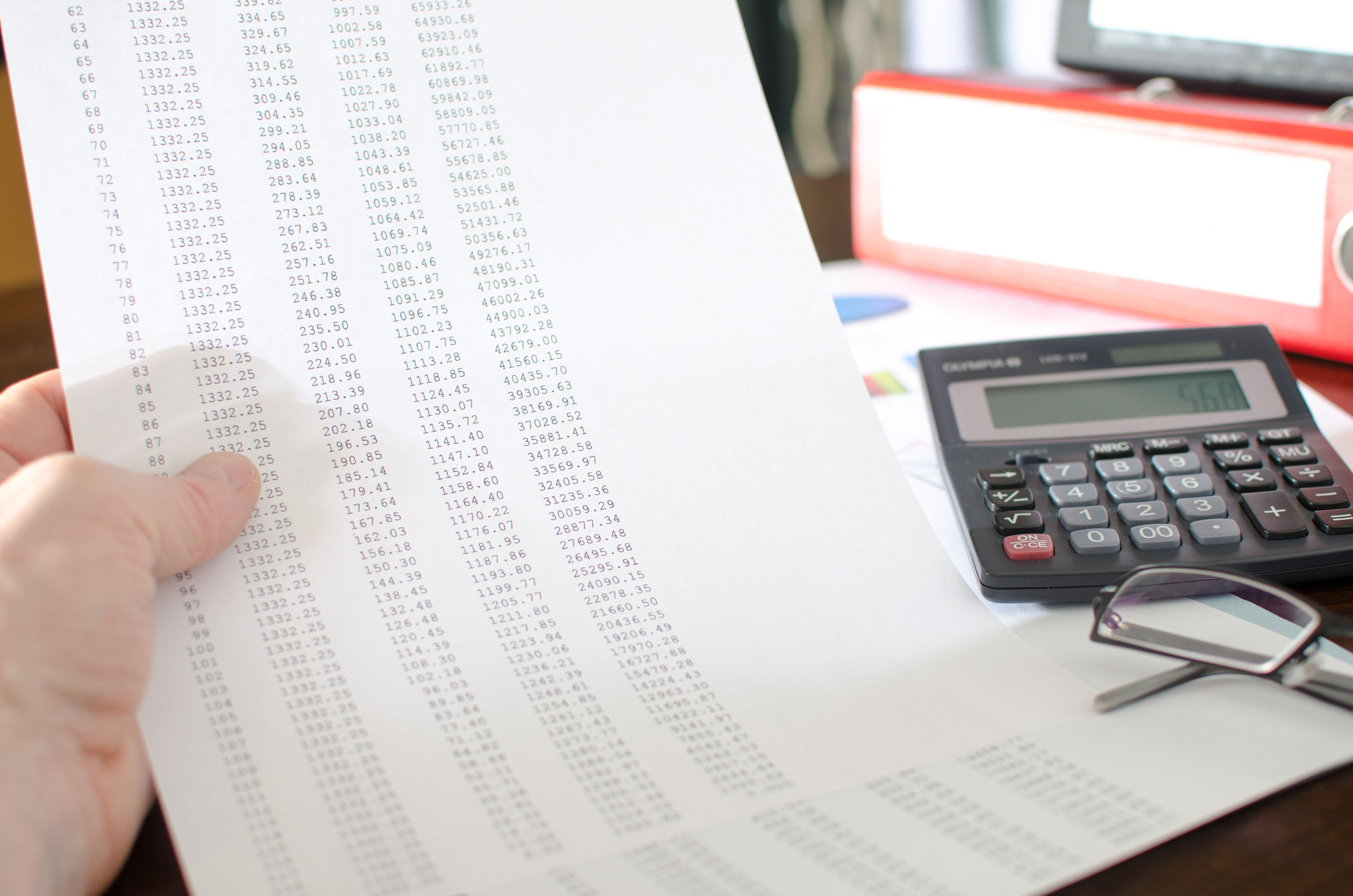

Bookkeeping refers to the process of tracking business expenses and income, allowing managers and owners to stay on top of cash flow and be aware of the overall health of their business. It is vital for bookkeeping to stay accurate and current to avoid account balance shocks and expenses, particularly for small business.

Why you need a bookkeeper for a small business

It is vital to have a bookkeeper for a small business for a number of different reasons.

One reason is that having a bookkeeper for a small business is a great way to keep information organized. Financial data is organized by accurate bookkeeping, making it much easier to understand and analyze.

Another good reason is that certain information is required to be tracked by the IRS such as accurate info on gross receipts, expenses, entertainment and travel expenses, employment taxes, purchases and assets.

Bookkeeping also helps with budgeting. Knowledge of the cash flow of a business means that resources can be allocated to the likes of new projects and launches that will be able to help with the growth of your business.

Better decision making is another benefit of bookkeeping. Ordered books mean you have an accurate account of the overall health of your business, which in turn allows for better decisions to be made regarding growth and operations.

It also allows for the tracking of profit. Business owners want their business to be as profitable as it can be and bookkeeping allows for the tracking of both progress and overall profits.

For more information, visit The Bookkeeper at https://thebookkeeper.com/ or follow The Bookkeeper on Instagram.