In the legal sector, accurate financial management is vital to the success of any law practice. As attorneys and legal professionals’ responsibilities expand, enduring complex financial activities like billing, spending, and trust accounts can become onerous. These services keep a firm’s financial records structured, compliant, and transparent, allowing lawyers to focus on their primary responsibility: providing legal services.

Streamline Financial Operations

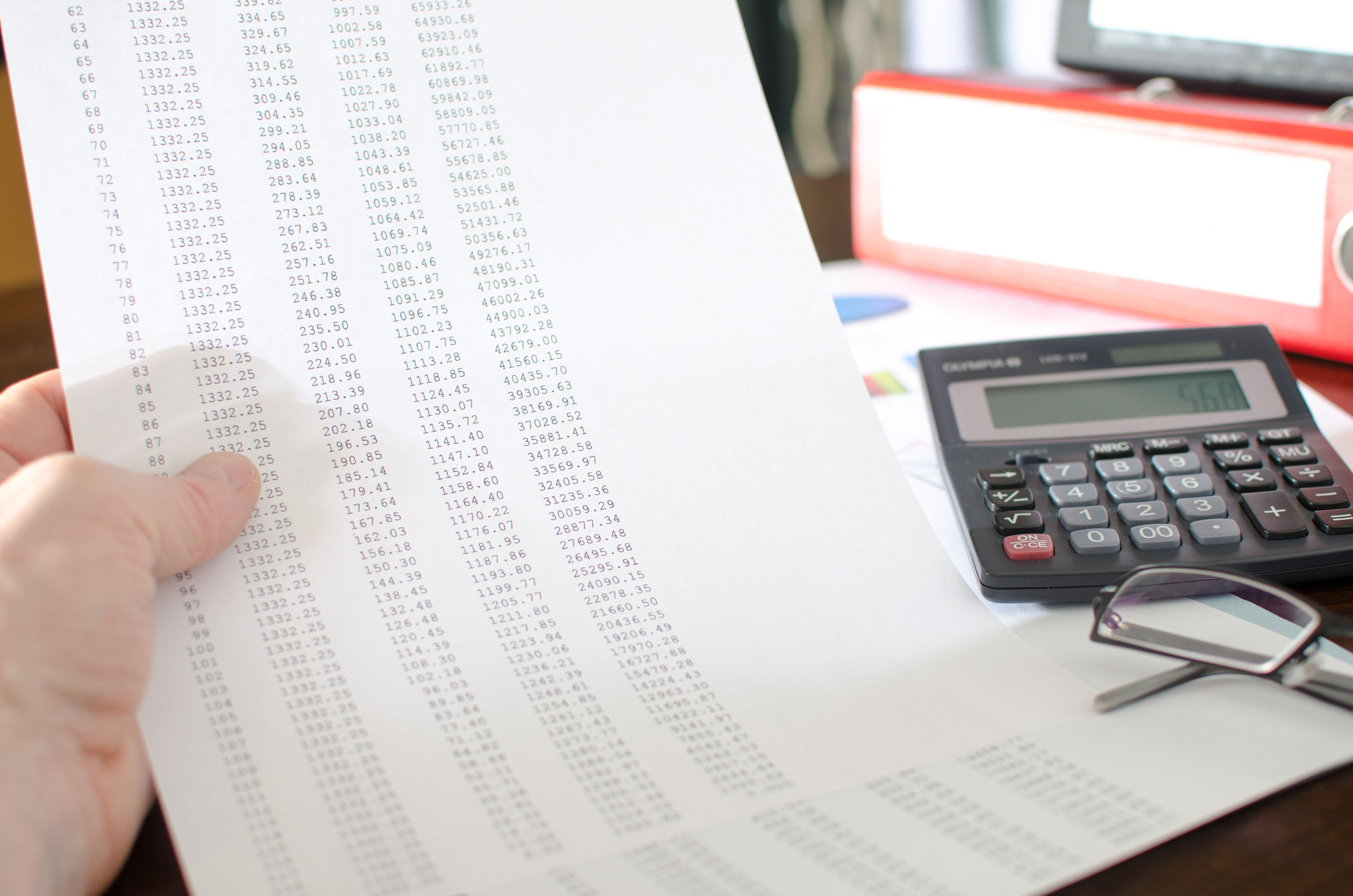

One of the primary benefits of using law firm bookkeeping services is that financial processes are streamlined. Legal companies can rely on these services to maintain their financial records meticulously, tailored to their unique requirements. By documenting all transactions, including client payments, retainers, and operations expenses, accounting services limit the possibility of errors that could result in financial inconsistencies.

Compliance and Accuracy

Accuracy is essential in the legal profession, and it also applies to financial management. Law companies must follow several restrictions, especially when working with trust accounts and client funds. Law firm bookkeeping services ensure that all financial transactions meet industry standards and legal regulations. It includes keeping accurate records of all economic activities, ensuring that tax filings are correct, and preparing reports that represent the firm’s financial situation. Using an experienced bookkeeping service increases accuracy while lowering the risk of penalties and legal difficulties.