Many small businesses in the Staten Island, NY, area do not have a need for a full-time CPA on staff. These companies may have a bookkeeper or use a software platform to manage their business, but they do not have a CPA.

This can create a situation where a small business is missing tax credits or deductions. In a worst-case scenario, the business may be out of compliance with tax laws, which can result in significant penalties.

Getting the Tax Help Needed

Using a Staten Island, NY, accounting firm is an excellent opportunity to have access to a dedicated CPA. These firms provide accounting and tax services for businesses throughout the area, with each business able to request the services they need.

Signs your small business would benefit from working with an accounting firm include:

• Business setup – the CPA from the firm can assist the business in creating a budget, writing a business plan, choosing the business structure, and ensuring all software for accounting is optimized to the needs of the business.

• Tax compliance – tax laws are constantly changing. Working with a local accounting firm on an ongoing basis ensures a small business stays in compliance with all tax laws.

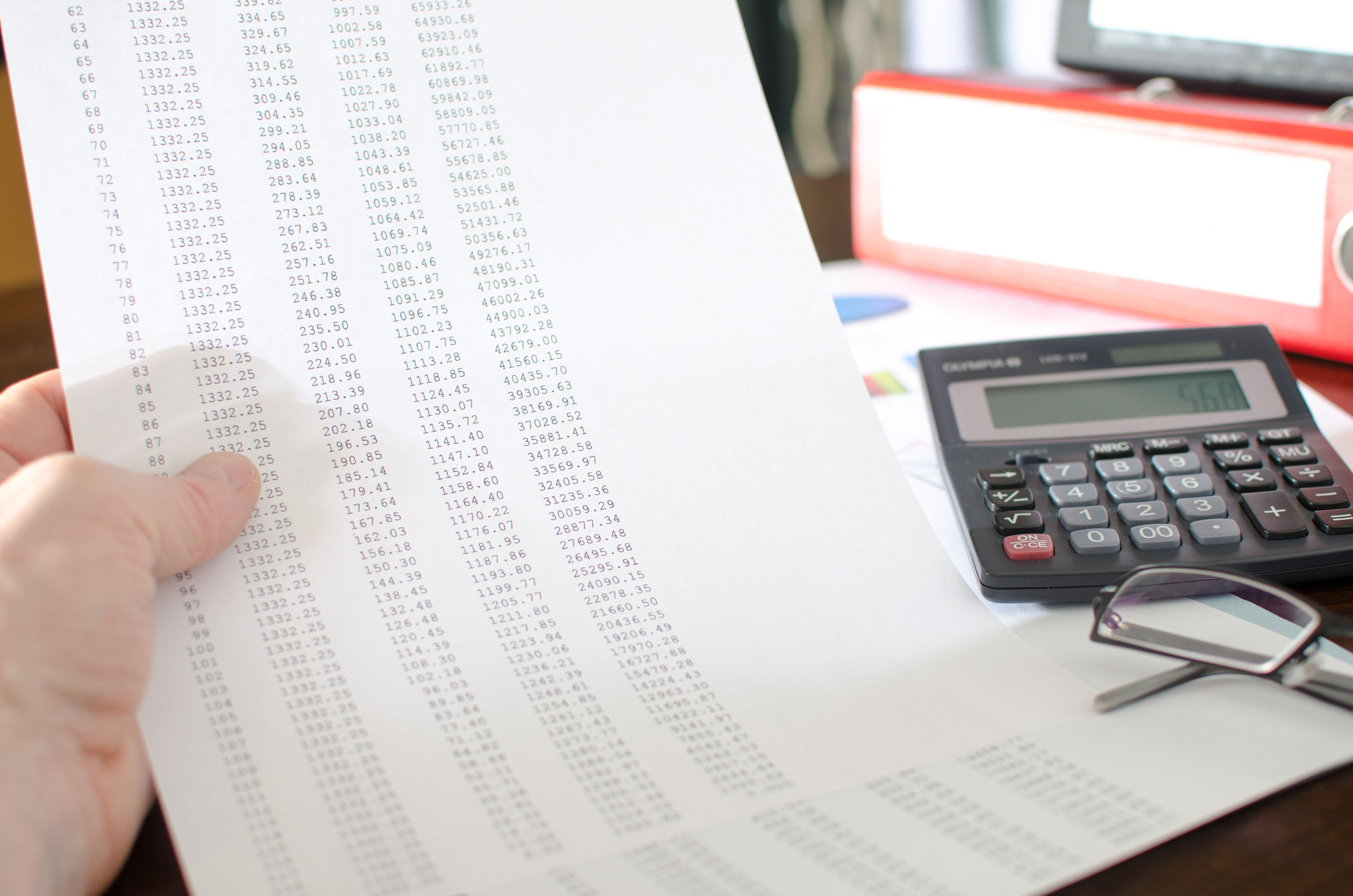

• Accurate recordkeeping and reporting – business owners often find it difficult to stay ahead of recordkeeping and reporting for their business. Hiring a bookkeeper helps with the day-to-day financial management, with the CPA able to provide the structure and overall plan.

Hiring a firm to manage small business accounting and taxes is the best way to ensure accuracy with your financial picture. Choosing a local firm makes it easy to communicate and plan for the success of your business.