Finances are complicated, even the everyday tasks of paying bills, setting aside spending money for the month, and trying to save money. People try to keep track of everything, get bills paid on time and in full, and attempt to set money aside for tuition, a down payment on a house, retirement, or even a family vacation. The truth is that most people do not realize where all their money goes. They work hard, try to stick to a budget, and still do not seem to have enough to accomplish what they want. Hiring professionals to handle Personal Accounting in Manhattan may be the answer. Having someone else take care of finances can make the difference between struggling and accomplishing long- and short-term goals.

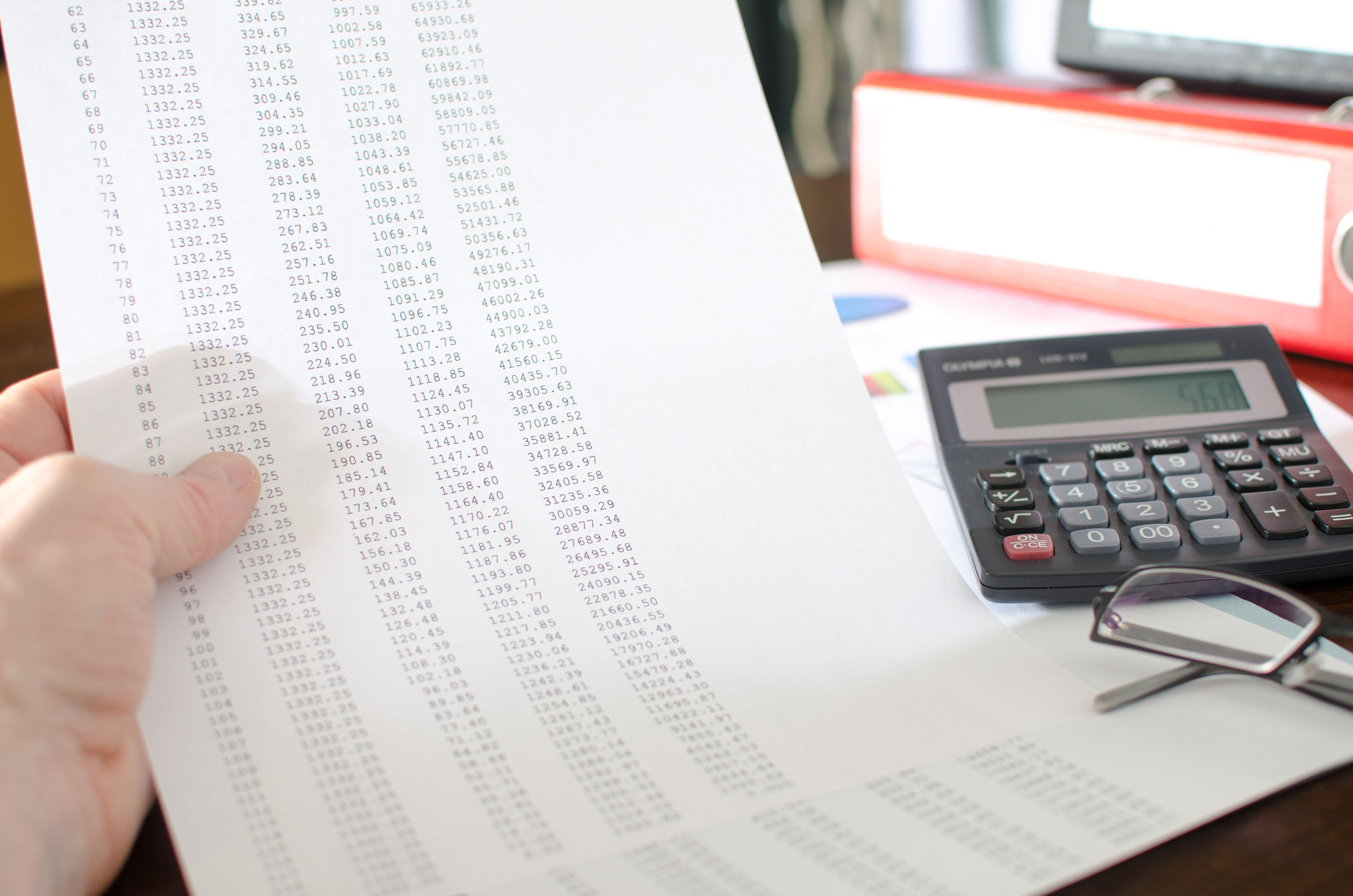

An accountant can assist with financial, trust, or estate planning; manage loan, mortgage, and tuition payments; provide financial statements and take care of tax preparation and filing. Monthly bills will be paid automatically, and savings can be deposited for a vacation, car, house, or for a buffer in case of emergencies. The family can receive a specific amount for groceries and entertainment or have money placed in a separate account for incidental spending.

Services for Personal Accounting in Manhattan can be customized to suit the comfort level of the client. If setting up an initial budget is the issue, the account can work with people to get a budget in writing. If quarterly reporting for a home business is what is needed, that service can be arranged. Services are available to suit individual needs and do not come in set packages. If people prefer to spend their free time relaxing or spending time with the family, an accountant can handle finances completely.

An additional benefit to having an accountant help with financial planning is that all tax regulations are taken into consideration when money is added to retirement accounts, trust funds, or tuition plans. Some accounts can only be increased by so much each year or can only have deposits made at certain intervals. Adding too much, or making more deposits than allowed, can result in heavy penalties assessed by the Internal Revenue Service (IRS). That would defeat the purpose of placing money into structured accounts in the first place. Tax laws are subject to change, and accountants keep up with changes and know the most current regulations. People can go to to set up an appointment for services.

To know more on this click Here!